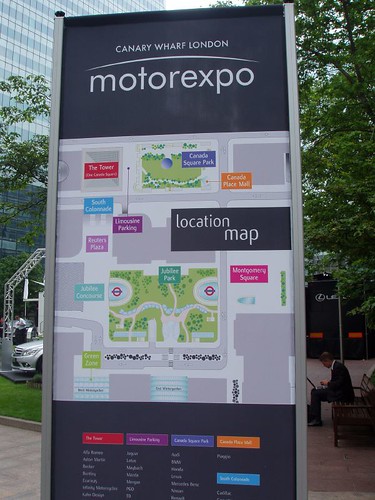

London Canary Wharf MotorExpo

Take a load of sexy cars, place them in the financial and commerical heart of Britain, and this is what you get. For a full week, London bankers, traders, financiers were treated to a bevy of motor vehicles ranging from the sexy Audi R8 to the environmentally conscious BMW Hydrogen 7 Series. Also not forgetting the extremely petit SMART cars.

Take a look at some of the pics taken:

Here's the heart-stopping Audi R8. Growl ... Bite your head off ...

Overheard between 2 bankers over an Audi A8...

Banker A: So what colour did you get?

Banker B: Got it in black.

wanker A: It's a real beauty isn't it? What are you going to do with your Beemer and the Lex?

wanker B: Yeah, looks like I have to get a bigger garage.

One of these A8 cost about 80k pounds. I bet these guys get like an annual bonus which could easily buy them 10 of these. The Ford GT - Only 500 of these are manufactured in the world:

The Ford GT - Only 500 of these are manufactured in the world: The environmentally conscious BMW Hydrogen 7 series. It sprouts out water instead of fumes. How's that for a car?

The environmentally conscious BMW Hydrogen 7 series. It sprouts out water instead of fumes. How's that for a car?

My kind of car - tells alot about me and my wife - both pretty SMART ;-)

The breath taking Aston Martin V8 Vantage Roadster. They were only uncovered for interested buyers - most of the time they are all covered beneath a black sheath.

The LandRover FreeLander2. You will never fail the park-on-the-steep-slope driving test with this fuel guzzler.

This may cost up to a fifth of the bankers' annual bonus ... hmmm ... Should we have this in pink my dear?

Back to reality ... Back to work ...